Is Cryptocurrency the New Gold Rush?

2017 was a year that Bitcoin turned its meager presence into a household name. From an increase to around $14,000 from just $280 two years ago (what would be a 4900% profit), it’s no question as to why many millennials are considering cryptocurrency as an alternative to traditional investment sources. If you compare this to stocks, the DOWJ went from roughly 15,700 to nearly 24,400, an approximately 60% increase.

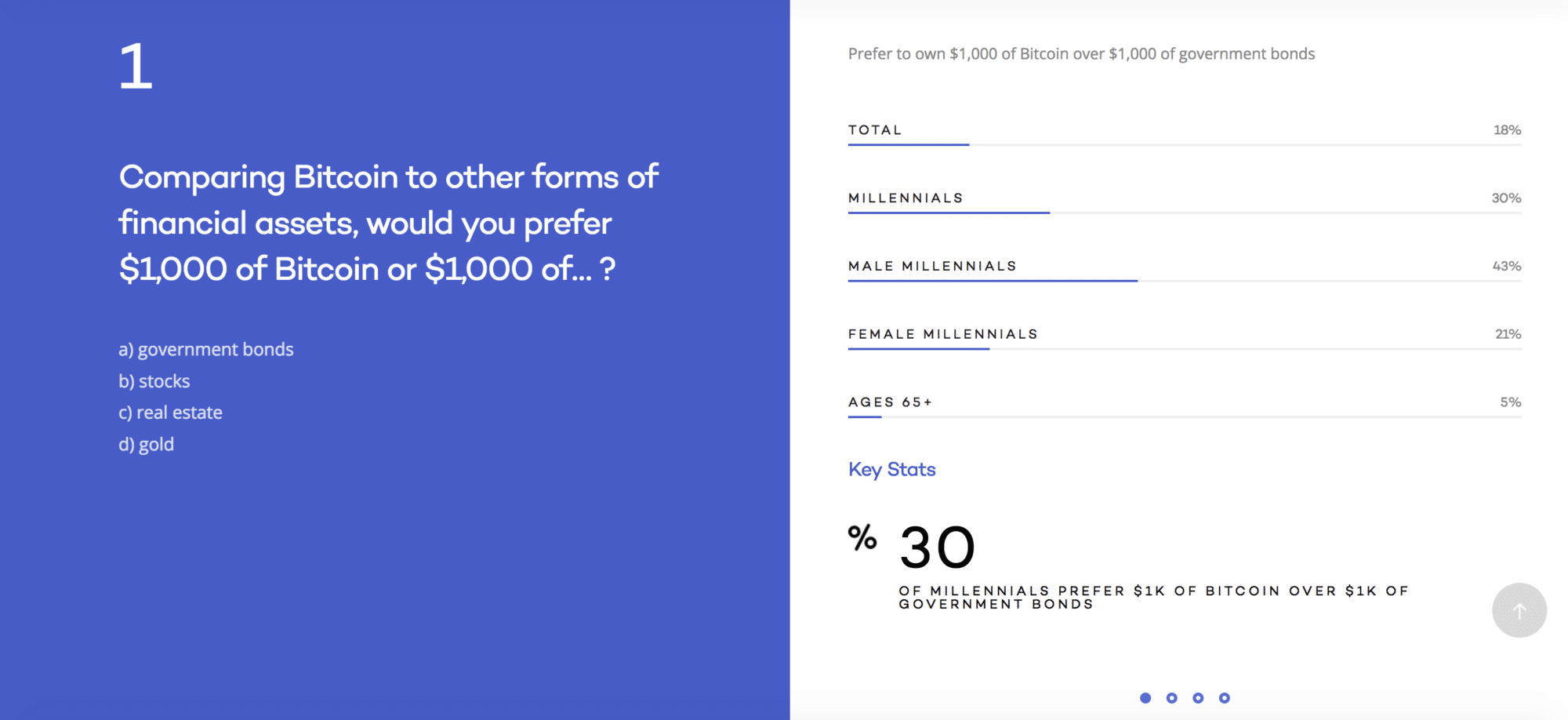

While traditional investments include assets such as gold and stocks, a survey conducted by “Harris Poll on behalf of Blockchain Capital” in the Fall of 2017 compared four capital investments to preference in holding stakes in Bitcoin. The online survey included more than 2000 U.S. adults ages 18+.

As you can see in the image above, although only 18% of the total number of respondents prefer to own Bitcoin over government bonds, 30% of millennial respondents would actually prefer Bitcoin over government bonds. Looking closer at the numbers, more than twice as many male millennials favor Bitcoin than their female counterparts.

When it came to stocks, 27% of millennials favored Bitcoin to stocks. Millennial males account for 38% compared to 19% of millennial females. As for real estate and gold, 22% of millennials prefer Bitcoin compared to real estate and 19% prefer Bitcoin over gold.

Like the massive wave of young adults dashing to California during the Gold Rush, many millennials are eager to sign up on exchange sites for their chance at small fortunes. So much so that exchanges are being overwhelmed and rejecting new user applications. Although the risks associated with spending fiat money on cryptocurrency are considered extremely high due to the speculative nature of the industry, the vast rewards involved with such stagnant increases in currency prices are hard to ignore.

Taking into consideration that the survey also shows that only 4% of millennials own or have previously owned Bitcoin, there’s a giant gap between what Millenials want to invest in compared to what they actually do invest in. In a survey of more than 2000 Americans by Bankrate, only 1 in 3 millennials invests in the stock market.

The Bankrate study supports the Blockchain Capital study that, as for now, millennials still favor investing in traditional financial assets. However, with growing interest and mass adoption of cryptocurrency, it’s not unreasonable for one to wonder if millennials will begin moving their assets from things like government bonds to Bitcoin, Ethereum, and/or altcoins testing the blockchain paradigm.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.